Gain insight into a big expense from this simple metric

For most small companies, labor is the biggest expense. So as a business owner or manager, you need to keep a close eye on the relationship between the money spent on employees and contractors and the resulting value created for the company. Surprisingly, though, metrics that measure the productive use of labor are often overlooked or ignored.

Don’t make that mistake, because there is valuable insight to be gained by looking at metrics like the Labor Efficiency Ratio (LER) over time and across various departments, clients, and even individual employees of your company.

To best understand LER, let’s start with its mathematical equation:

Gross Margin (Revenue – Cost of Sales) / Labor Costs

So, as you can see, LER measures how much a unit of revenue costs to produce.

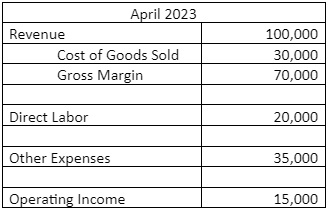

For example, let’s say you own a manufacturing outfit that produces industrial-grade valves. Here is a simple profit and loss statement (P&L) we can use to calculate your LER:

Here, we divide $70,000 by $20,000 to get 3.5, so that is your LER for the month of April. The higher the number, the better.

Now that you have the LER, what do you do with it? That answer is multi-faceted, but one thing at the top of the list is tracking it over time to see if and how it fluctuates.

Also, note that LER is commonly used to calculate labor efficiencies for workers who don’t actually “make” the good or service you offer to the world – think management or the sales team, for example.

We will talk more about how to use LER next time.

SBS can help you with LER and all the relevant accounting and financial metrics for your small business, gaining you insight and making your company more profitable.

Contact us at info@sbsaccountants.com or 770-284-5537 today for a consultation.