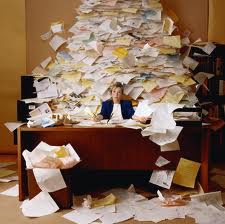

As a small business owner or employee, one thing you don’t want more of is paper. Yet, before you shred – yes, shred rather than toss in the trash – important documents, you need to know the guidelines on how long to keep documents, tax records and other important papers.

As a small business owner or employee, one thing you don’t want more of is paper. Yet, before you shred – yes, shred rather than toss in the trash – important documents, you need to know the guidelines on how long to keep documents, tax records and other important papers.

The amount of time to keep a document varies based on the action, expense or event of your recorded document. For all records that have an item of income, deduction or credit shown on your tax return, you need to keep those records until the period of limitations for that tax return ends. The period of limitations represents the time you have to rectify your tax return in order to claim a credit or refund, and the IRS can charge additional tax.

After your tax return is filed, the period of limitations depends on your situation:

- If you filed a non-fraudulent return that correctly reported all income, keep the records for 3 years.

- Keep the records for 6 years if you failed to report the income and that income represents more than 25% of your gross income shown on that return.

- For non-filed or fraudulent returns, keep the records forever.

Let’s say you file a claim for credit or refund after you file your return. If that’s the case, then you still only need to keep those records for 3 years from the date you filed the original return, or 2 years from the date you paid the tax, whichever comes last. In addition, if you claim a loss from worthless securities or bad debt deduction, keep your records for 7 years.

Make sure that you keep employment tax records for a minimum of 4 years after the date that the tax becomes due or is paid, whichever comes later. And, always have copies on hand of your filed tax returns. It will pay off when preparing future tax returns, making calculations for an amended return, or even when you apply for a mortgage or other type of loan.

Even when these records have clear the period of limitations, you may still need to keep them for other reasons. For example, your insurance company may want them longer; check with them and other vendors to ensure you’re meeting their requirements. Visit this page for an official IRS list of document retention guidelines.

So, first and foremost, keep your records safe and secure, and only discard or dispose of them when you’re 100% sure that you won’t need them again. The last thing you want is to be caught short without access to important papers.

For assistance, contact us today. We will help answer any questions or concerns!