Small businesses are especially susceptible to fluctuations in cash flow, so owners and

managers need to continually monitor their company’s cash balance. As we’ve outlined

previously, the cash balance report is a great way to that.

Beyond the cash balance report, though, it’s important to understand the difference between

profit and cash flow, because this often get owners in trouble. Just because a business is

profitable does not mean that it has positive cash flow. How can this be?

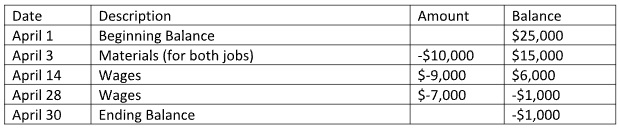

Let’s look at an over-simplified example to illustrate the point. Say you own a home repair

service and had two jobs in April, one major that you charged $30,000 for and one minor that

you charged $10,000 for. Here is what your business checking account might look like for the month:

You had anticipated finishing the jobs in April, but weather was bad during the first part of the

month, delaying completion until early May. So, you couldn’t invoice your customers to get

payment until then. Even though you made a net profit on the two jobs combined of $14,000

($40,000-$26,000), your cash flow is actually negative for April, and you’ve overdrawn your

checking account!

There are several things you can do to avoid this potential disaster, which is all too common for smaller companies.

For one, monitor your Accounts Receivable and, if necessary, adjust the way you invoice.

Running a tight ship in this area will help you avoid headaches down the road, and keep the

cash flowing in. Be sure you are looking at the right key performance indicators (KPIs).

Additionally, communicate proactively and regularly with your customers about invoices

coming due.

You should also be forecasting your revenue and expenses, so you can plan for potential cash crunches down the road and make any adjustments accordingly. Financial forecasting can range from simple to complex, but don’t over-complicate it. Even a minimalist model looking six or 12 months into the future can be highly informative.

If you would like to discuss how to improve the condition of your company’s cash flow or create

forecasting models of your financials, contact us at info@sbsaccountants.com or 770-284-5537

today for a consultation.