Small business owners must pay close attention to financial reports, because they give essential insights into the financial health and performance of the business.

Correctly analyzing the balance sheet, income statement, and cash flow statement will yield invaluable insights into the company’s profitability, liquidity, and overall stability.

You can think of each of your financial reports as a treasure map, which can guide you to a

hidden chest of gold knowledge, if you know where to look.

What do we mean? Well, it can be quite complex and you need to get help from someone with experience, but there are three main ways to dissect the information in your financials.

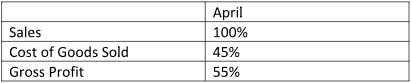

First, using vertical analysis, you can compare each line item on a financial statement to a base

figure to assess its relative proportion. On an income statement, for example, sales will be the

top-line figure, at 100%, and all other accounts be a percentage of that number. This highly

simplified chart illustrates the point:

Vertical analysis is useful in identifying trends, such as shifts in expense allocation.

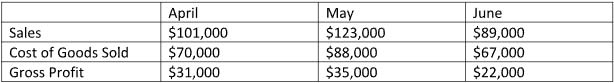

Second, there is horizontal analysis, or trend analysis, where you compare financial data over various periods of time. You can evaluate growth rates and identify potential areas of concern using this method, and you might also find benchmarking data from your industry beneficial here.

We at SBS prefer a rolling 12-month snapshot to clearly see what happened in the same category in prior periods. Here’s a condensed 3-month example for illustration:

Finally, ratio analysis uses various key performance indicators (KPIs) to tell the story of what’s going on financially. Some typical ratio KPIs employed in this method are profitability ratios such as gross margin, liquidity ratios such as current ratio and quick ratio, and solvency ratios such as debt-to-equity ratio. These can be a “dashboard” kind of approach to interpreting financial data.

Regularly reviewing your financial statements is a great step towards gaining an enhanced

understanding of what’s going on with your company.

But you need expertise who know what the best KPIs are for your particular situation, and can

look at the picture holistically. Context is king when it comes to financial statements, and

figuring out where danger might be lurking involves taking a step back and seeing external, as well as internal factors.

SBS can help you interpret your financials and make wise decisions from the data to become

more profitable in the future.

Contact us at info@sbsaccountants.com or 770-284-5537 today for a consultation.